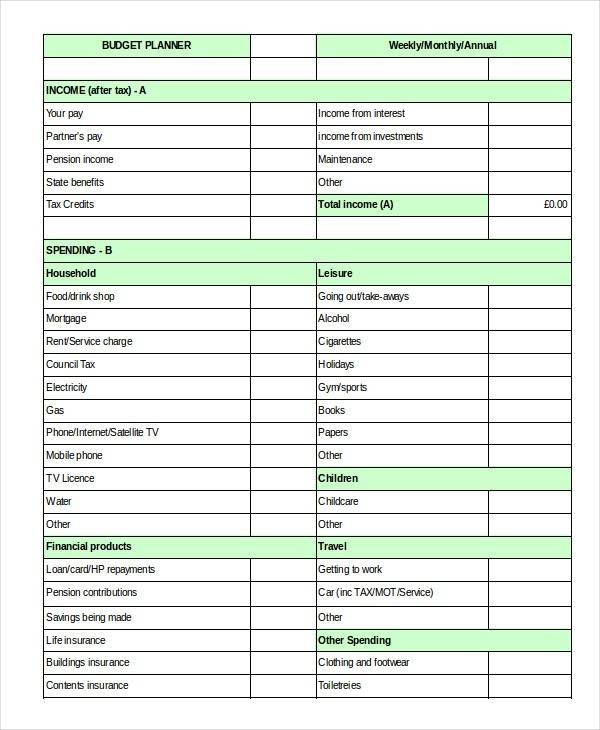

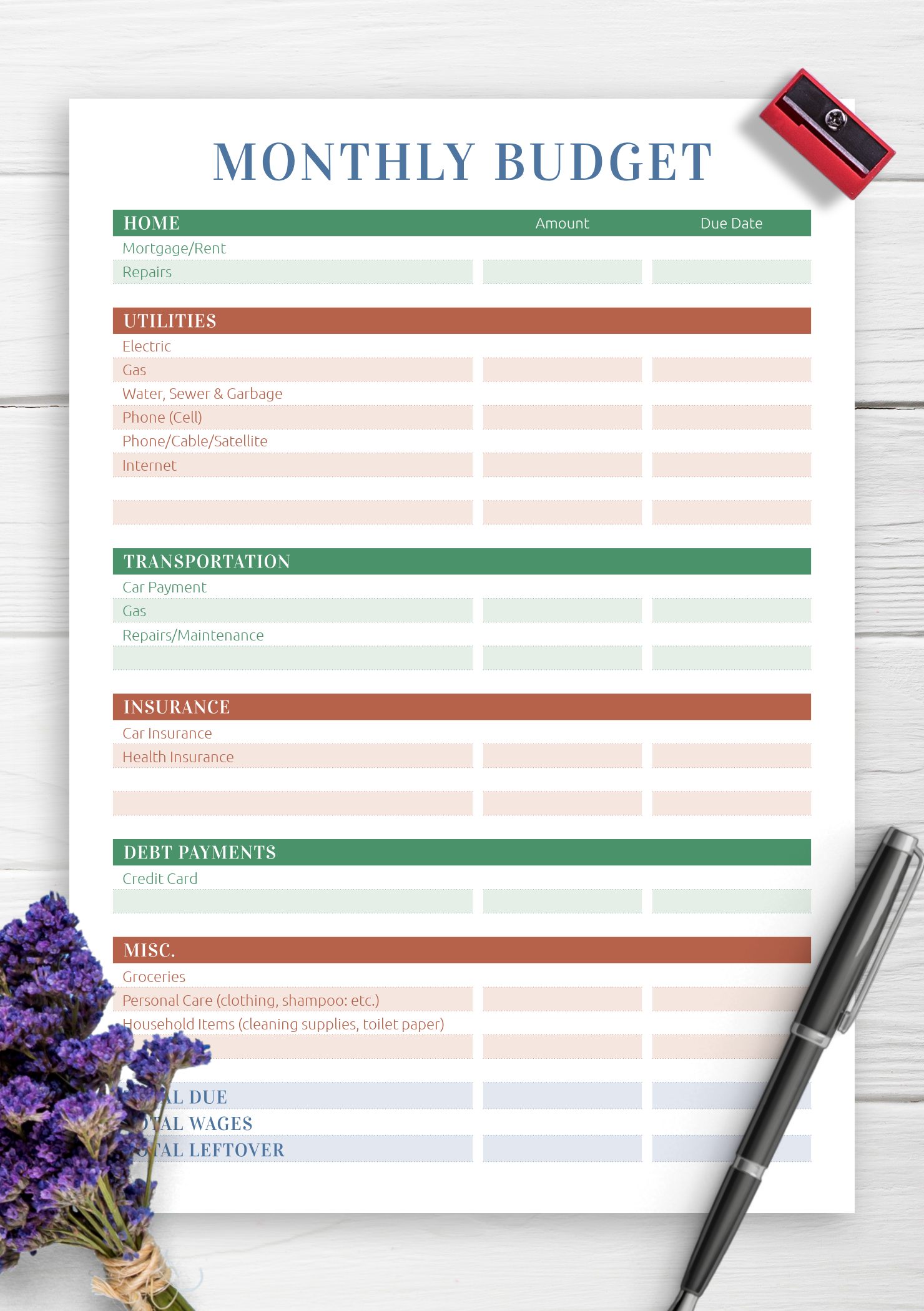

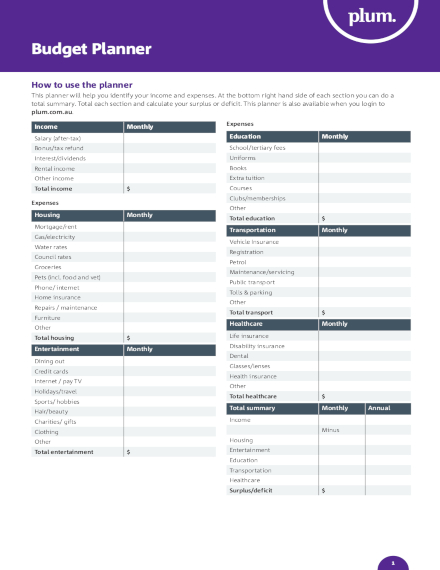

This list should also include your monthly debt payments. Don’t forget to include the non-monthly expenses, which includes payment for insurance premiums, school tuition fees, property taxes, etc.

FAMILY BUDGET PLANNER FREE

How can they all fit within a single budget?ĥ Financial Planning Mistakes That Cost You Big-Time (and what to do instead!) Explained in 5 Free Video Lessons Elements For Creating A Budget

FAMILY BUDGET PLANNER PLUS

However, the process can be confusing because there are so many different expense categories plus some expenses get paid monthly, others quarterly, and still others only occur annually. The purpose of budgeting is to allocate your income between your estimated expense categories for the month. But before you jump in, make sure that you are ready with your list of inputs necessary for creating a budget. There are lots of free budget planners online that can help you create your first budget template. If this is your scenario then this Budget Calculator can help you take control of your money and get your savings back on track. Is there more month than money to pay for it?

FAMILY BUDGET PLANNER HOW TO

How To Start Saving And Control Spending Using A Budgetĭo you ever wonder where all your money goes? This calculator works great in tandem with the expenses calculator here to compare these suggested allocations with your actual spending.Īnd if you'd like to take the next step beyond budgeting and start growing wealth then take this free 5 video lesson course 5 Rookie Financial Planning Mistakes That Cost You Big-Time (and what to do instead!) Higher incomes will have larger percentages for pension and insurance but lower for food. For example, lower incomes will have higher percentages for necessities like food.

Your personal budget will vary within these percentages based on personal preferences and income level. You can then create a household budget worksheet to use as a reference point for creating a budget. Bureau of Labor Statistics against various personal finance guru recommendations.

These ranges were determined by cross referencing the Consumer Expenditure Survey from the U.S. Income (annual or monthly) and this budgeting tool will calculate the conventional spending amounts based on normal percentage ranges.

0 kommentar(er)

0 kommentar(er)